Looking for a way to buy Bitcoin without revealing your identity? Non-KYC Bitcoin ATMs are gaining popularity as they allow users to purchase cryptocurrency without going through Know Your Customer verification processes. These machines offer a level of privacy that traditional exchanges can’t match, making them an attractive option for privacy-conscious individuals.

What Are Non-KYC Bitcoin ATMs?

Non-KYC Bitcoin ATMs are cryptocurrency machines that allow users to buy Bitcoin without providing identification documents. Unlike traditional exchanges that require extensive personal information, these ATMs enable more private transactions, especially for smaller amounts typically under $1,000.

These machines operate similarly to regular ATMs but instead of dispensing cash, they facilitate the purchase of Bitcoin and sometimes other cryptocurrencies. The key difference is the absence of identity verification requirements that are standard on most regulated platforms.

Benefits of Using Non-KYC Bitcoin ATMs

Enhanced Privacy

The primary advantage of non-KYC Bitcoin ATMs is the privacy they offer. Users can purchase Bitcoin without linking their personal identity to their cryptocurrency holdings. This prevents exchanges, governments, and other entities from tracking your Bitcoin purchases or spending habits.

Speed and Convenience

Non-KYC Bitcoin ATMs offer significantly faster transactions compared to exchanges that require verification. There’s no waiting period for account approval or identity verification – simply insert cash, scan your wallet QR code, and receive Bitcoin within minutes.

This immediacy makes these ATMs particularly valuable for those who need to make quick purchases without delays.

Financial Inclusion

For unbanked or underbanked individuals without access to traditional financial services, non-KYC Bitcoin ATMs provide an entry point to the cryptocurrency ecosystem. These machines accept cash, making them accessible to those without bank accounts or credit cards.

Protection from Data Breaches

By not providing personal information, users protect themselves from potential data leaks. Centralized exchanges that collect KYC information create honeypots of sensitive data that can be targeted by hackers, as has happened numerous times in the crypto industry.

Ready to try a privacy-focused Bitcoin ATM?

Find non-KYC Bitcoin ATMs near your location and start purchasing cryptocurrency anonymously today.

Risks and Considerations

Advantages

- Enhanced privacy and anonymity

- No personal data stored by exchanges

- Quick transactions without verification delays

- Cash-friendly for unbanked individuals

- Protection from exchange hacks and data leaks

Disadvantages

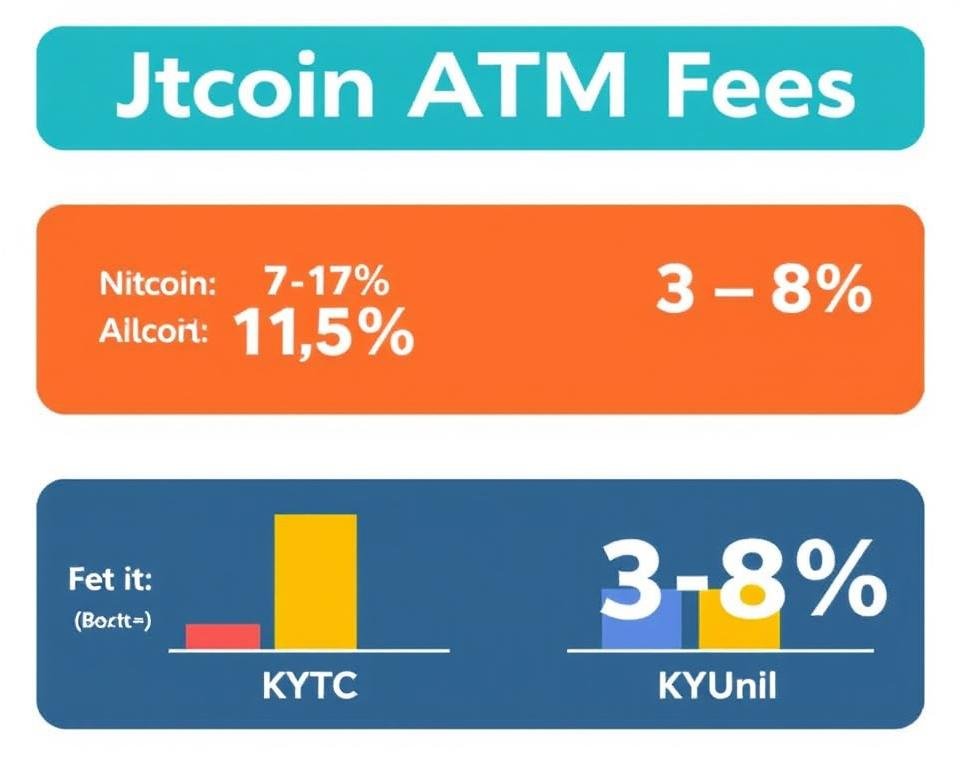

- Higher fees (typically 7-15% above market rate)

- Lower transaction limits (usually under $1,000)

- Fewer locations compared to KYC ATMs

- Potential for increased regulatory scrutiny

- Risk of using machines operated by untrustworthy vendors

Higher Transaction Fees

Non-KYC Bitcoin ATMs typically charge significantly higher fees than online exchanges or KYC-compliant ATMs. These fees can range from 7% to 15% above the market rate, making them one of the more expensive ways to purchase Bitcoin.

Limited Transaction Amounts

To comply with anti-money laundering regulations while still offering non-KYC service, most of these ATMs impose strict transaction limits. Typically, you can only purchase between $500-$1,000 worth of Bitcoin without providing ID, depending on the operator and location.

Potential Scams

The anonymous nature of non-KYC Bitcoin ATMs can make them targets for scammers. Some machines may be operated by untrustworthy vendors who might charge excessive fees or even manipulate exchange rates without clear disclosure.

Always research the ATM operator before using their machines and check reviews from other users to ensure legitimacy.

Legal Status of Non-KYC Bitcoin ATMs in the US

The regulatory landscape for non-KYC Bitcoin ATMs varies significantly across the United States. While these machines operate in a legal gray area in some jurisdictions, others have implemented strict regulations.

Federal Regulations

At the federal level, Bitcoin ATM operators are considered Money Services Businesses (MSBs) and must register with the Financial Crimes Enforcement Network (FinCEN). However, FinCEN guidelines allow for transactions under certain thresholds without full KYC verification.

For transactions over $10,000, Currency Transaction Reports (CTRs) are mandatory, regardless of whether the ATM is advertised as “non-KYC.”

State-by-State Variations

State regulations can significantly impact the availability and operation of non-KYC Bitcoin ATMs:

| State | Non-KYC Status | Transaction Limits | Notes |

| New York | Not Available | N/A | BitLicense requirements prohibit non-KYC operations |

| Texas | Available | Up to $500 | More permissive regulatory environment |

| Florida | Available | Up to $900 | High concentration of non-KYC ATMs |

| California | Limited | Up to $500 | Increasing regulatory scrutiny |

Important: Regulations are constantly evolving. Always check the current legal status in your state before using non-KYC Bitcoin ATMs. While using these machines may be legal, they still operate within broader anti-money laundering frameworks.

Where to Find Non-KYC Bitcoin ATMs in the US

Finding non-KYC Bitcoin ATMs requires some research, as not all Bitcoin ATMs offer this option. Here are the best resources and locations to help you find these privacy-focused machines:

Online ATM Locator Tools

Coin ATM Radar

The most comprehensive Bitcoin ATM directory that allows filtering for machines with no ID requirements for smaller transactions.

Bitcoin ATM Map

A mobile-friendly option that provides real-time updates on ATM status and verification requirements.

Operator Websites

Many ATM operators maintain their own locator tools with detailed information about verification requirements.

States with Highest Availability

Non-KYC Bitcoin ATMs are not evenly distributed across the United States. These states have the highest concentration of machines offering anonymous transactions:

- Florida: Particularly in Miami and Orlando areas

- Texas: Houston, Austin, and Dallas have numerous options

- California: Despite increasing regulation, still has many machines

- Nevada: Las Vegas has a high concentration of non-KYC options

- Georgia: Atlanta area offers several non-KYC machines

Common Locations

Non-KYC Bitcoin ATMs are typically found in these types of establishments:

Convenience Stores

Gas Stations

Shopping Malls

Verification Reality Check: Even ATMs advertised as “non-KYC” may still require some basic verification like a phone number for SMS verification or scanning a QR code. True zero-verification machines are becoming increasingly rare due to regulatory pressure.

Ready to find a non-KYC Bitcoin ATM near you?

Use Coin ATM Radar to locate the closest non-KYC Bitcoin ATM and start your anonymous crypto journey today.

How to Use Non-KYC Bitcoin ATMs

Using a non-KYC Bitcoin ATM is straightforward, but there are some important steps to follow to ensure a smooth transaction:

Before You Visit

- Set up a Bitcoin wallet on your smartphone if you don’t already have one

- Research the ATM’s fee structure and transaction limits

- Bring sufficient cash and your smartphone

- Check the ATM’s operating hours

Step-by-Step Purchase Process

Step 1: Select Buy Option

Choose “Buy Bitcoin” on the ATM’s touchscreen interface.

Step 2: Scan Your Wallet

When prompted, scan the QR code of your Bitcoin wallet address.

Step 3: Insert Cash

Insert the desired amount of cash into the machine.

Step 4: Confirm Transaction

Review the amount, fees, and exchange rate, then confirm your purchase.

Step 5: Get Receipt

Take your receipt as proof of transaction (if provided).

Step 6: Receive Bitcoin

Check your wallet to confirm the Bitcoin has been received (may take 10-30 minutes).

Tips for a Successful Transaction

- Verify the machine: Check that you’re using a legitimate ATM from a reputable operator

- Double-check the wallet address: Ensure you’re scanning the correct wallet QR code

- Be aware of fees: Understand the premium you’re paying over market rates

- Consider transaction timing: Network congestion can affect confirmation times

- Maintain privacy: Be mindful of security cameras in the ATM location

- Keep your receipt: It contains important information if there are any issues

Alternatives to Non-KYC Bitcoin ATMs

If you can’t find a non-KYC Bitcoin ATM near you or prefer other methods, consider these alternative options for purchasing Bitcoin without identity verification:

Peer-to-Peer Exchanges

Platforms like Bisq, Hodl Hodl, and RoboSats connect buyers and sellers directly, often without requiring KYC verification.

These decentralized exchanges typically use escrow systems to ensure safe transactions between parties.

In-Person Cash Transactions

Local Bitcoin meetups or platforms like LocalCoinSwap facilitate face-to-face transactions where you can pay cash directly to a seller.

Always meet in public places and consider using the platform’s escrow service for security.

Prepaid Cards

Some exchanges accept prepaid debit cards or gift cards as payment methods without requiring full KYC verification.

This method adds a layer of privacy between your identity and your Bitcoin purchases.

“Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn’t want the whole world to know, but a secret matter is something one doesn’t want anybody to know.”

Conclusion: Balancing Privacy and Practicality

Non-KYC Bitcoin ATMs offer a valuable option for those seeking privacy in their cryptocurrency transactions. While they provide significant benefits in terms of anonymity and accessibility, they come with trade-offs including higher fees and lower transaction limits.

As regulations continue to evolve, the availability of truly anonymous Bitcoin purchases may become more limited. For those prioritizing privacy, combining multiple non-KYC methods and staying informed about local regulations is essential.

Whether you choose to use non-KYC Bitcoin ATMs or alternative methods, understanding both the benefits and risks allows you to make informed decisions about your cryptocurrency purchases.

Ready to explore non-KYC Bitcoin options?

Find the nearest non-KYC Bitcoin ATM or explore alternative privacy-focused methods for purchasing cryptocurrency.

Frequently Asked Questions

Are non-KYC Bitcoin ATMs legal in the United States?

Yes, non-KYC Bitcoin ATMs are generally legal in most states, though they operate under transaction thresholds (typically 0-

Frequently Asked Questions

Are non-KYC Bitcoin ATMs legal in the United States?

Yes, non-KYC Bitcoin ATMs are generally legal in most states, though they operate under transaction thresholds (typically $500-$1,000) to comply with anti-money laundering regulations. Some states like New York have stricter requirements that effectively prohibit truly non-KYC operations. Always check your local regulations.

How much do non-KYC Bitcoin ATMs charge in fees?

Non-KYC Bitcoin ATMs typically charge higher fees than their KYC counterparts, ranging from 7% to 15% above the market rate. This premium reflects the added privacy benefit and the higher regulatory risk operators take by offering non-KYC services.

What information might still be collected by “non-KYC” ATMs?

Even ATMs advertised as “non-KYC” may still collect some basic information such as a phone number for SMS verification or biometric data like a palm scan. They may also have security cameras. True zero-information machines are increasingly rare due to regulatory pressure.

What’s the maximum amount I can purchase without ID?

Transaction limits vary by operator and location but typically range from $500 to $1,000 for non-KYC transactions. Some machines may offer tiered verification, allowing higher limits with minimal information (like a phone number) while still not requiring full ID verification.

,000) to comply with anti-money laundering regulations. Some states like New York have stricter requirements that effectively prohibit truly non-KYC operations. Always check your local regulations.

How much do non-KYC Bitcoin ATMs charge in fees?

Non-KYC Bitcoin ATMs typically charge higher fees than their KYC counterparts, ranging from 7% to 15% above the market rate. This premium reflects the added privacy benefit and the higher regulatory risk operators take by offering non-KYC services.

What information might still be collected by “non-KYC” ATMs?

Even ATMs advertised as “non-KYC” may still collect some basic information such as a phone number for SMS verification or biometric data like a palm scan. They may also have security cameras. True zero-information machines are increasingly rare due to regulatory pressure.

What’s the maximum amount I can purchase without ID?

Transaction limits vary by operator and location but typically range from 0 to

Frequently Asked Questions

Are non-KYC Bitcoin ATMs legal in the United States?

Yes, non-KYC Bitcoin ATMs are generally legal in most states, though they operate under transaction thresholds (typically $500-$1,000) to comply with anti-money laundering regulations. Some states like New York have stricter requirements that effectively prohibit truly non-KYC operations. Always check your local regulations.

How much do non-KYC Bitcoin ATMs charge in fees?

Non-KYC Bitcoin ATMs typically charge higher fees than their KYC counterparts, ranging from 7% to 15% above the market rate. This premium reflects the added privacy benefit and the higher regulatory risk operators take by offering non-KYC services.

What information might still be collected by “non-KYC” ATMs?

Even ATMs advertised as “non-KYC” may still collect some basic information such as a phone number for SMS verification or biometric data like a palm scan. They may also have security cameras. True zero-information machines are increasingly rare due to regulatory pressure.

What’s the maximum amount I can purchase without ID?

Transaction limits vary by operator and location but typically range from $500 to $1,000 for non-KYC transactions. Some machines may offer tiered verification, allowing higher limits with minimal information (like a phone number) while still not requiring full ID verification.

,000 for non-KYC transactions. Some machines may offer tiered verification, allowing higher limits with minimal information (like a phone number) while still not requiring full ID verification.